Friday, February 27, 2009

NEW TECHNOLOGY!!!

I found this new tool called Chat To Text that allows you to add a texting link to any web based communication.

You just add it to your profile page (Facebook, MySpace, etc) , your email, (or your blog) and your friends and colleagues can send you a private text message to your cell phone, and you can reply with your cell phone and they'll get it while they're still on your profile page!

There is a 5-minute video that explains it all.

Full Disclosure:

There is a $6 monthly fee and it has an MLM component to it (you are not required to participate). But as a technology feature alone it is well worth it.

You do not have to pay a fee to SEND texts but you do have to pay the monthly fee ($5.99) if you want to receive them on your cell phone.

California Imposes New Foreclosure Moratorium. There's a catch!

Foreclosure Moratorium Seen in California

February 25, 2009

Gov. Arnold Schwarzenegger has reportedly signed into law a 90-day moratorium on California home foreclosures — but the measure carries certain exemptions for servicers. According to a report in The Orange County Register, state regulators can grant loan servicers and lenders exemptions, if they have a mortgage modification program in place that meets certain criteria. The measure covers owner-occupied homes and first mortgages originated between 2003 and 2007. The loan mod exemptions cover programs that defer a portion of the principal, lower interest rates for at least five years, or extend loan terms. Sen. Ellen Corbett, D-San Leandro, introduced the moratorium language as an add-on to the California budget package.

Late Mortgage Payments Are On The Rise

Freddie Sees Spike in Late Payments

February 25, 2009

Freddie Mac saw a spike in delinquencies in the month of January along with lackluster issuance of mortgage-backed securities and portfolio activity. The mortgage giant said its serious delinquency rate shot up 26 basis points since December to 1.98%. In January 2008, the percentage of loans 90 days for more past due was 0.71%. Meanwhile, the secondary market agency issued $16.3 billion in MBS, up slightly from $15.8 billion in December. Ginnie Mae issued $26.5 billion in single-family MBS in January. Freddie also said the size of its mortgage portfolio declined slightly to $798.9 billion. The Treasury Department recently doubled its financial backing of Freddie to $200 billion to increase market confidence in the government-sponsored enterprise, which is expected to report a large loss for the fourth quarter. Treasury also increased the GSE's portfolio limit by $50 billion to $900 billion.

Recession or Depression?

Definitions:

GDP (Gross Domestic Product): The monetary value of all the finished goods and services produced within a country's borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

Recession: A period of negative, real GDP growth, usually during two consecutive quarters.

Depression: there are varying definitions including 1. a recession that lasts more than one year to a 10% decline in real GDP growth for the period.

Thursday, February 26, 2009

Best/Worst Housing Markets

Friday, February 20, 2009

Another Foreclosure Loophole...

Right to Rescind/TILA Moves to Block Foreclosures Increase

February 19, 2009

Servicers are seeing increased cases where borrowers are trying to stall or stop foreclosures by filing "right to rescind" notices as violations of the Truth in Lending Act, according to speakers at the MBA's National Mortgage Servicing Conference in Tampa. During a panel on mortgage litigation, Terry Hutchens, president of the law firm of Hutchens, Senter & Britton, said that debtors attorneys are claiming that borrowers were given inadequate documents at the time of closing and did not understand the loan, which judges are starting to honor. It's worth it for servicers to try and negotiate a settlement or consider a loan modification with the borrower rather than take the case through expensive litigation, he said. "We're not so vulnerable that we are rolling over in every case, but we have to consider doing things differently than we have in the past," said Mr. Hutchens. "It can cost as much as $200,000 if you have to take it to trial." Shaun Ramey, a partner with Sirote & Permutt PC, said servicers must decide how to handle these new cases. Cities, states and counties are putting giant roadblocks up to fight foreclosures, he said. "There are new claims and new defenses. Public nuisance lawsuits are coming up because foreclosures are driving up the cost of mounting properties sitting around and the cost it takes to maintain them." It was also said that claims of reverse redlining are being brought against lenders at the city level as well as borrowers bringing suitability actions against lenders. "If the judges feel that something isn't right, they will stop the foreclosure."

Municipalities Get Aggressive on REO

Municipalities Get Aggressive on REO

February 19, 2009

Local municipalities across the country are increasing penalties and fining lenders as much as $100 a day for code violations such as each broken window on an REO home, according to speakers on the vacant property registration panel at the Mortgage Bankers Association's National Mortgage Servicing Conference in Tampa. Robert Klein, chief executive of Safeguard Properties, said servicers need to make sure their property preservation units communicate with code enforcement officials at the city and county levels to open up dialogue and prevent this from happening. "If you won't listen, they will look for every legal measure they can to inflict some pain," he said. Cary Sternberg, senior vice president, American Home Mortgage Servicing, said servicers are searching for creative and aggressive strategies to dispose of these properties while figuring out the best way to preserve the assets. They are partnering up with preservation vendors to update the carpet, paint, and if needed, replace the roof, in order to make sure the home is in "lendable condition." Caroline Reaves, president and chief operating officer, Mortgage Contracting Services, said more mid-value and high-end properties are seeing cosmetic enhancements with furniture staging. The panelists also said home managers are sometimes being used to maintain the property and travel from house to house, to occupy and maintain the house.

Local municipalities across the country are increasing penalties and fining lenders as much as $100 a day for code violations such as each broken window on an REO home, according to speakers on the vacant property registration panel at the Mortgage Bankers Association's National Mortgage Servicing Conference in Tampa. Robert Klein, chief executive of Safeguard Properties, said servicers need to make sure their property preservation units communicate with code enforcement officials at the city and county levels to open up dialogue and prevent this from happening. "If you won't listen, they will look for every legal measure they can to inflict some pain," he said. Cary Sternberg, senior vice president, American Home Mortgage Servicing, said servicers are searching for creative and aggressive strategies to dispose of these properties while figuring out the best way to preserve the assets. They are partnering up with preservation vendors to update the carpet, paint, and if needed, replace the roof, in order to make sure the home is in "lendable condition." Caroline Reaves, president and chief operating officer, Mortgage Contracting Services, said more mid-value and high-end properties are seeing cosmetic enhancements with furniture staging. The panelists also said home managers are sometimes being used to maintain the property and travel from house to house, to occupy and maintain the house.

Pockets Of CA Real Estate Are Showing Signs Of Recovery

- Sonoma County: Unit sales are up by more than 100% since 1/08, Homes are selling at 96.5% of list price with an average days on market of 107.

- Alameda County: Unit sales are up by more than 135% since 1/08, Homes are selling at 97.6% of list price with an average days on market of 59. The <$500K homes represent 80% of sales which is a distinct difference from the 20% they represented as recently as 2006.

- Contra Costa County: Unit sales are up by nearly 24% since 1/08, Pending sales are up 29%, Days of inventory has dropped to 202, from 272 a year ago.

- San Diego County: Unit sales are up 48% since 1/08, Homes are selling at 95.65 of list price with an average days on market of 63. Although bank -owned properties continue to represent the majority of sales in this county the number are still impressive.

Thursday, February 19, 2009

If We Had Only Listened To Peter Schiff...

I don't know which is more unsettling; the detailed accuracy with which he forecast the reason we were going into a recession or the vehemence with which so many other "experts" argued against him.

Take a minute to Google "Peter Schiff" and you will find even more information.

Wednesday, February 18, 2009

Interesting Website For Real Estate Investors

Tuesday, February 17, 2009

Foreclosure Loophole?

Follow Up: Unlawful Foreclosures

Here is the link to the original blog:

Illegal Foreclosures Could Make "Proof of Product" Mandatory

Monday, February 16, 2009

Interesting Idea: Bail Out Real Estate Investors

This is a very interesting idea and worthy of consideration. The only thing I would disagree with is the writers opinion that there are "two" reasons that foreclosures take place. In fact there is only one reason for foreclosure: lack of payment. There are a number of reasons for lack of payment i.e. job loss, payment adjustment, illness, just to name a few.

Bail out the real estate investors

Perspective: Loan mods, first-time buyers can't rescue housing

February 13, 2009 12:55 PM

By Inman News

Inman News

By DAVID CURRY

If we are to believe the "experts," the economic condition we find ourselves in is a direct result of housing prices and foreclosures. The entire recession is being blamed on housing and foreclosures and financial woes stemming from bad loans. These facts are why the "experts" are declaring that since housing led us into this mess, housing must lead us out of it. Sounds nice, but it obviously isn't that easy.

There's a massive pork-laden bill of "change" being touted as stimulus that is supposed to take us one step closer to solving this financial and housing crisis. President Obama and his fellow experts have somehow lost sight of what they've already told us the problem is. The problem is with housing. We don't need to build roads and re-sod the National Mall -- we need to stem the tide of foreclosures, and more specifically we need to get the foreclosed (bank-owned or REO) properties off the open market so prices will stabilize.

In a national market where we may sell only 4.5 million residential housing units this year, we may have as many as 2.5 million homes in some sort of foreclosure process. That means a glut of inventory of the REO type, and that means lagging prices for all until that inventory is cleared from the open market. The problem isn't a lack of stimulus from Washington, it's the REO properties. In order to help fix the economy, the foreclosures need to be front and center in the process. How to do it?

We've already tried loan modification for consumers who are facing foreclosure. I never liked that option, and now that loan modification has proven completely futile in preventing foreclosures, let's just get past that as being a viable option.

Remember, folks are getting foreclosed on for two primary reasons: Either they lost their job -- in which case, buying them 60 days or reducing their rate by a percent isn't going to make an ounce of difference -- or they've just decided to let the bank take their upside-down home. It's amazing how many people still think that loan modifications are the way out of this mess. They're not, and all they're doing is delaying our free-market recovery.

So once we get past loan modification as a means of stemming the foreclosure tide, let's get straight to the foreclosed homes that now flood our markets with REOs and drive prices downward as banks cut bait and run.

First, you have to understand the REO process, and the condition of most REO homes. The process is daunting, unkind to consumers, and filled with procedural folly. The homes are generally run-down, can be stripped of appliances, curtains and copper piping, and are in general disrepair. Many were winterized improperly by the banks who own them, and there are mechanical issues just waiting to be discovered.

In short, these homes require capital by purchasers. To say nothing of tightened lending standards, these homes will require money to fix them up once a sale is complete. This is the situation, yet as a nation we're looking to the first-time homebuyer to bail us out of this REO mess? Not a chance. First-time homebuyers generally lack the capital and desire needed to fix up the property, and are many times scared off by the process of an REO purchase. The answer isn't in the first-time homebuyer, as NAR and Washington would like us to believe -- which is why they offered that $7,500 first-time homebuyer credit (loan) last year. The answer lies with the real estate investor. Keep reading.

Every market, no matter how small, has a handful of serious real estate investors. These are guys and gals who own rental properties, who buy and sell for a living or for fun, and who just like playing with real estate and making money in the process. These people have the capital required to pull off an REO purchase and repair, and they have the knowledge to see how the investment can pay off. These are also the buyers that are for the most part sitting on the sidelines waiting for prices to become even more attractive. These are the buyers who can absorb much of the REO inventory in this country should they so desire. These buyers are the answer to our REO crisis. Yet the NAR and Washington don't realize it. They're throwing money at first-time homebuyers, trying to throw money at road projects, millions to save mice in California, and billions in bank bailouts, but they're not offering incentives to the actual demographic that is willing to get their hands dirty and bail us out of this mess.

Here's my proposal to fix this mess: Stop modifying loans for individuals. If they want to get foreclosed on, let the process begin, and let's hurry it up so we don't string this recovery out any longer than necessary. (My apologies to those who have lost their jobs, but please remember, I'm a Realtor, which means I basically lost my income but continue to work harder than ever, so I understand your plight.)

Force the banks that have been receiving TARP funds (and will receive more) to lend 75 percent of the money they're receiving. Loans are readily available, but anyone who tells you they're just as easy to get as they used to be needs to go out and get a loan themselves right now so they shut up and realize the lending world has changed.

Then the "piece de resistance" (a French phrase meaning "outstanding event"): tax credits and capital gains tax abolition. Investors who are purchasing these homes need motivation to do so, and the motivation is easily accomplished with a two-step plan.

First, offer a $15,000 federal income tax credit to any buyer who purchases an REO or short-sale property. Make the $15,000 good for the tax year that they purchased the home in, and apply it as you would a child tax credit -- just take the amount off the taxpayer's bottom line. That provides an immediate, significant piece of motivation that is realized during the year of the purchase.

Next, make the gain from the sale of such a purchase free from capital gains tax for a period of seven years from the date of purchase. That would apply to short-term and long-term capital gains, as well as sales completed in less than 12 months when the gain would be taxed as ordinary income.

Take the capital gain problem one step further, and reduce the overall capital gains tax rate from 15 percent to 8 percent. That would give the residential and commercial markets a shot in the arm. The incentive here is obvious: Let's allow these investors to buy and sell these toxic homes, or rent them for a number of years and then sell them when the market improves, and let's let them keep 100 percent of their profits. After all, they're bailing us out of this mess, so let's throw them a monetary bone. This sort of actual market stimulus wouldn't require capital expenditures by the federal government, it would just result in less tax revenue, which means ... gasp ... they'd have to spend less money (it's called conservatism) .

If we could piece together these two bits of legislation, we could see a dramatic increase in REO sales, which would benefit housing prices, the overall economy, and in turn the financial markets. If a buyer buys an REO home for $100,000, he is giving business to his lender, insurance agent, utility companies and title company immediately. If he then spends $15,000 on improvements, he's putting tradesmen back to work, buying materials, and stimulating the local economy. If he sells that home for $160,000, he's paying a Realtor, a title company, the state, and hopefully, just hopefully, making $30,000 or so in 100 percent profit, which he'll in turn spend on the tires that his truck has been needing.

See how this works? It's called capitalism, and perhaps the federal government and President Obama ought to give it a try.

David Curry is a Realtor in Lake Geneva, Wis.

Saturday, February 14, 2009

Executive Pay Limits : Final Word

Friday, February 13, 2009

The American Dream

Please watch closely, this may be a sign that the bottom is near. Keep in mind that just because we hit "bottom" doesn't mean we won't "drag along the bottom" for a period of time, before a true recovery happens.

Thursday, February 12, 2009

U.S. may subsidize troubled mortgages: sources

Helpful Indicator For Real Estate Recovery

Freddie Mac....Your New Landlord?

Coincidentally, Freddie Mac announced that EXACT plan for dealing with foreclosures.

I think you will find other banks following suit on this strategy because it just makes sense. The added benefit it that once the bank (or in this case Freddie) decides to sell the asset it will now be an income producing property that has been kept up, thereby making it more attractive to investors and allowing the bank to secure a higher price.

Friday, February 6, 2009

Goldman Sachs Wants To Return TARP Funds

Thursday, February 5, 2009

Helpful Indicator For Real Estate Recovery

I need your help:

If anyone knows of a free website that offers this data, please forward the link so I can share with my readers.

Winans: No End to Housing Woes in Sight

February 4, 2009

Researchers at investment management and research firm Winans International, Novato, Calif., predict that housing prices will not recover in 2009. "This bear market will probably not end in 2009. Past real estate markets ended when the average time it took to sell a new house dropped to three and a half months. Currently, it is taking over nine months for transactions to close due to tight credit conditions," said president and founder Ken Winans. Furthermore, home prices nationally have fallen 23% since March of 2007, according to The Winans International Real Estate Index. Sales are down 71% since that time and listings have contracted 34%, according to the index. The firm said that the inventory of new homes on the market reached a record time to sell high of 16.5 months in December.

Robin S. Reed

robin@proequitymanagement.com

A Closer Look At Executive Compensation Limits

Another Sign of Global Economic Meltdown

In another alarming reminder of the global economic meltdown, the following photos and information was sent to me by JMO Reader Chris Paul. Thanks Chris!

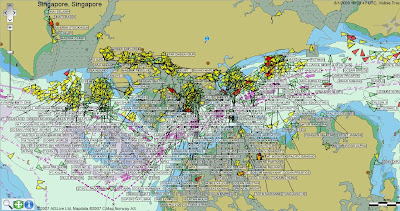

All the vessels you see are either empty or have empty containers on them and are Anchored. Which means other countries are not buying goods to be shipped from other parts of the world. Singapore is the busiest port in the world. The third map is the names of all the vessels anchored.

We remember the famous Port of Los Angeles/Long Beach meltdown of 2004 wherein longshoremen labor was short and over 100 loaded ships were at berth and anchor in the two ports. The attached pictures tell a different story. These are ships at anchor empty or loaded with empty containers to avoid on dock empty container storage charges in Singapore.

This tells a lot about the Global Economy.

Tuesday, February 3, 2009

"Bad Bank" impact on the REO Industry

Quote:

"No one knows what these assets are worth because the markets that normally value them are either shut down tight by fear or aren't providing prices that anyone believes."

Quote:

"In other words, at this point in the crisis, many banks have no choice other than to accept whatever the government sets as a price."

Quote;

"Because the experience of other countries that have used the bad-bank model for solving a financial crisis -- Sweden is the best example -- says taxpayers can actually come out ahead if the government buys at a good price and hangs on until financial markets recover."

Quote:

"Not all troubled assets would go into a bad bank -- only the worst ones. Less-damaged assets would stay with the banks but get government guarantees."

It would be worthwhile to read the entire article, however the above quotes could signal a very significant change in the REO landscape.

- Once a price/value is determined for the assets those caught holding any REO inventory that was purchased at a higher strike price could have to shift from a buy/turn strategy to a buy/hold strategy, which would tie up capital possibly for years to come.

- If the government follows the strategy implemented in Sweden, it could virtually eliminate the originating source of product thereby reducing supply, increasing demand and driving prices up. This would be good if you current;y hold properties but bad if your strategy is to buy and turn.

- If the government archives the worst properties, it could set the market price much higher for desirable properties. This would be good if you current hold properties, but bad if you are trying to get a foothold on inventory to purchase as there would be no short term exit strategy.

ProEquity Management has designed strategies to make sure our clients are properly positioned for these potential changes. If you are a buyer, a seller or a documented representative feel free to give me a call and I will share our strategies.

Robin S. Reed

Managing Partner

PHONE 480-242-1952

EFAX 480-907-2746

EMAIL robin@proequitymanagement.com

SKYPE robinsreed

BLOG http://jmoblog-proequity.blogspot.com/